Weekly Logistics & Parcel Industry Update

Week 7, February, 2026

Market Overview

The global parcel and freight forwarding industry continues to adjust to a more normalized but highly volatile market environment. Over the past week, industry leaders, postal authorities, and analysts have signaled a clear shift toward cost discipline, network optimization, and operational resilience, as freight rates ease while pressure on margins remains.

From ocean freight normalization to last-mile network restructuring, the industry is entering a phase where execution efficiency and system-level visibility matter more than scale alone.

Key Industry Developments This Week

1. DSV expects freight rates to ease as Red Sea transit routes reopen

credit: trans.info

The world’s largest freight forwarder DSV forecasts a decrease in global freight rates with the planned resumption of Red Sea and Suez Canal routes, freeing capacity and reducing transit times. It also sees global air and sea freight volumes rising 2–3% in 2026.

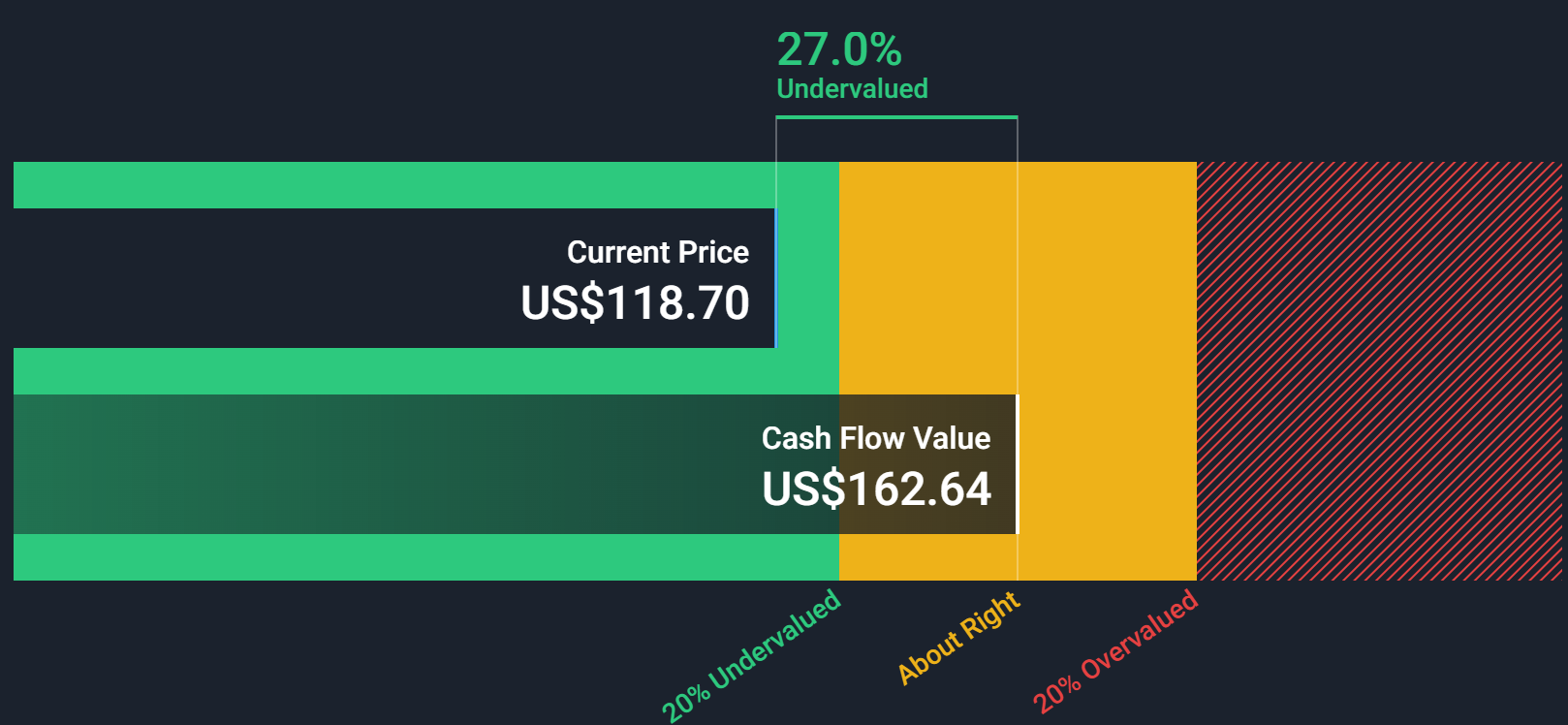

2. United Parcel Service beats earnings expectations and confirms 2026 outlook

credit: simplywall.st

United Parcel Service reported Q4 2025 results that exceeded market expectations and reaffirmed its revenue guidance for 2026, signaling continued emphasis on network cost control and operational optimization.

3. USPS launches bidding platform to expand last-mile delivery access

credit: reuters

The U.S. Postal Service has initiated an online bidding platform to open access to its last-mile delivery network, enabling shippers to bid for delivery capacity at over 18,000 destination delivery units across the country.

4. Smart systems drive growth in China's parcel logistics infrastructure

credit: chinadaily

China's parcel logistics industry is rapidly adopting automated sorting, robotics, and intelligent infrastructure, enabling large-scale parcel processing and supporting continued capacity expansion.

5. U.S. logistics and transport sectors face layoffs and bankruptcies

Closures, restructurings and bankruptcies are reshaping the U.S. logistics and manufacturing workforce at the start of the year. (Photo: Jim Allen/FreightWaves)

At the beginning of 2026, major logistics, rail, package delivery, and manufacturing firms in the U.S. experienced increased layoffs and bankruptcy filings, reflecting market volatility and rising operational cost pressures.

What This Means for Freight Forwarders and Parcel Operators

Across all segments, the message is consistent:

Volume growth alone is no longer enough

Operational transparency and collaboration are becoming competitive differentiators

Data-driven decision-making is critical as margins tighten

Freight forwarders and parcel operators that invest in process standardization, real-time visibility, and cross-party collaboration will be better positioned to navigate the next phase of the market.

Looking Ahead

As the industry moves into the next quarter, attention will remain on:

Freight rate stability

Network and cost optimization

Cross-border compliance and last-mile collaboration

We will continue tracking these developments and sharing weekly insights on how technology and operational models are evolving across the global logistics ecosystem.