Every SaaS company eventually answers the same question: How to balance the rising cost of software building with what customers can afford to pay?

Over the past year, logistics software pricing has changed—not just in structure, but in complexity. What once began as a shift away from traditional seat-based licenses has, in many cases, evolved into layered pricing models, where forwarders are charged simultaneously per user, per shipment, per container, and sometimes per automated process or AI feature.

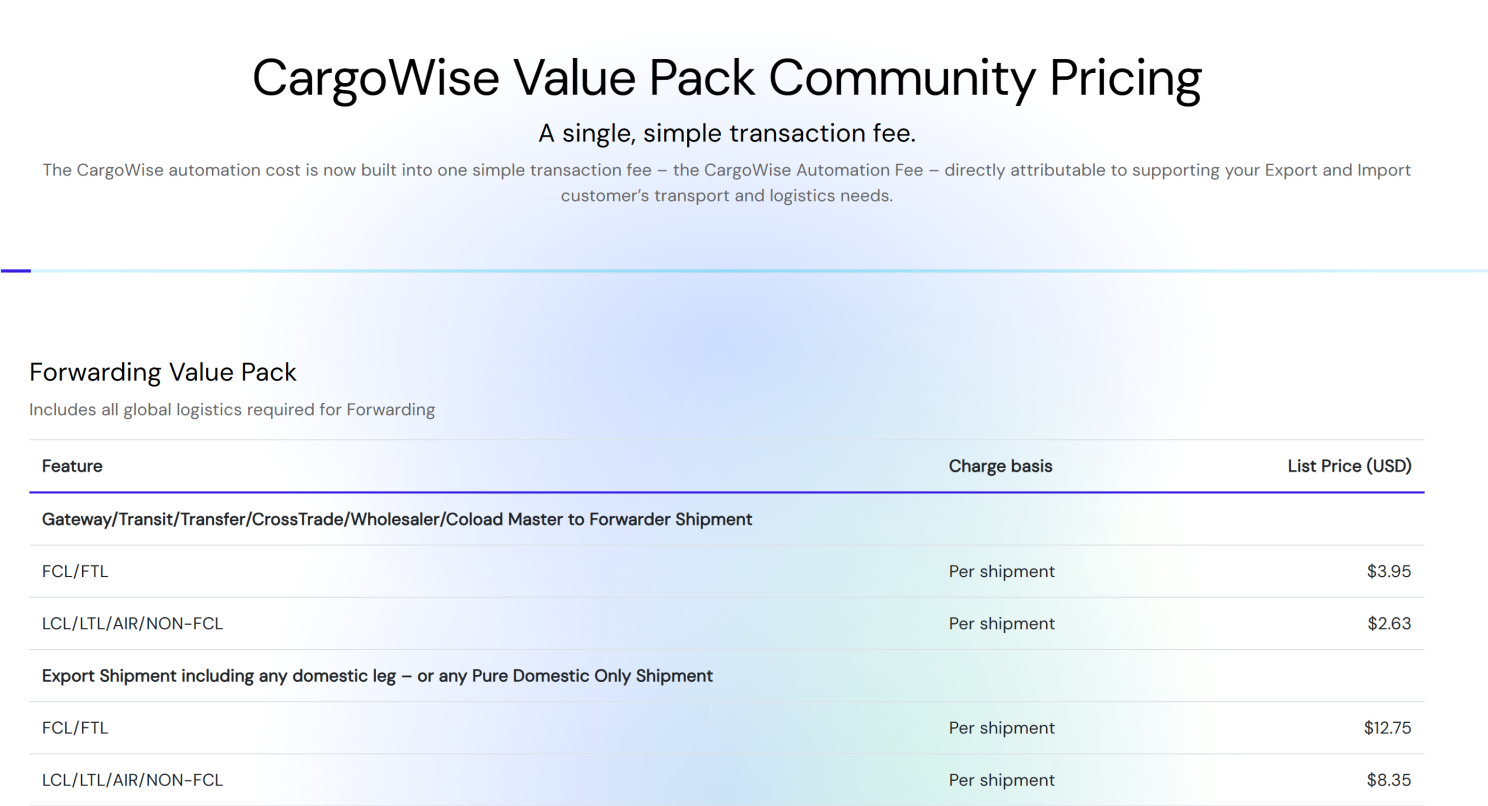

credit: cargowise.com

Individually, each charge may seem reasonable. Together, they create a cost structure that can grow faster than the business itself.

As these pricing models are rolled out globally, one reality is becoming increasingly clear: for many small and mid-sized forwarders, the total cost has become difficult to justify—let alone sustain.

When Pricing Layers Add Up

In theory, transaction-based pricing aligns software cost with business activity. In practice, many logistics platforms now apply multiple pricing dimensions to the same shipment.

A single transaction in a SaaS logistics system may involve:

User-based account access fees

Charges per shipment or job

Charges per container

Mandatory vendor application costs or added application costs

For large enterprises with strong margins, these layers may be manageable. For forwarders operating in competitive, high-volume markets, they are not.

When margins are thin, layered pricing turns software into a compounding expense. As volume grows, costs increase across several dimensions at once—often faster than revenue. Predictability disappears, and budgeting becomes guesswork.

It is not surprising that more forwarders are quietly reassessing their systems.

Why Small and Mid-Sized Forwarders Feel the Pressure First

In many markets, logistics service providers cannot easily pass rising software costs on to customers. Pricing is competitive, shippers are cost-sensitive, and software expenses are widely seen as part of a forwarder's internal operating cost.

As a result, complex pricing structures tend to hit small and mid-sized companies first. These businesses rely on scale, speed, and efficiency—but not on unlimited budgets.

Increasingly, the result is not deeper system adoption, but the opposite:

Features go unused to avoid extra charges

Growth is constrained to control cost

Some companies exit platforms entirely, searching for alternatives that better match their economics

This shift is less about rejecting advanced technology, and more about seeking balance between capability and affordability.

Cost Transparency Alone Is Not Enough

Global logistics platforms continue to set strong benchmarks in automation, standardization, and cross-border visibility. These contributions matter.

But in day-to-day operations, freight forwarders evaluate systems on more than feature depth alone. Three factors consistently shape long-term decisions:

Pricing simplicity – Can costs be understood and predicted without constant recalculation?

Operational flexibility – Are advanced tools optional, or bundled by default?

Market fit – Does the system align with how logistics businesses actually operate, locally and regionally?

When pricing becomes too complex, even strong platforms risk losing relevance for a large segment of the market.

A Simpler Alternative Doesn't Mean Less Capability

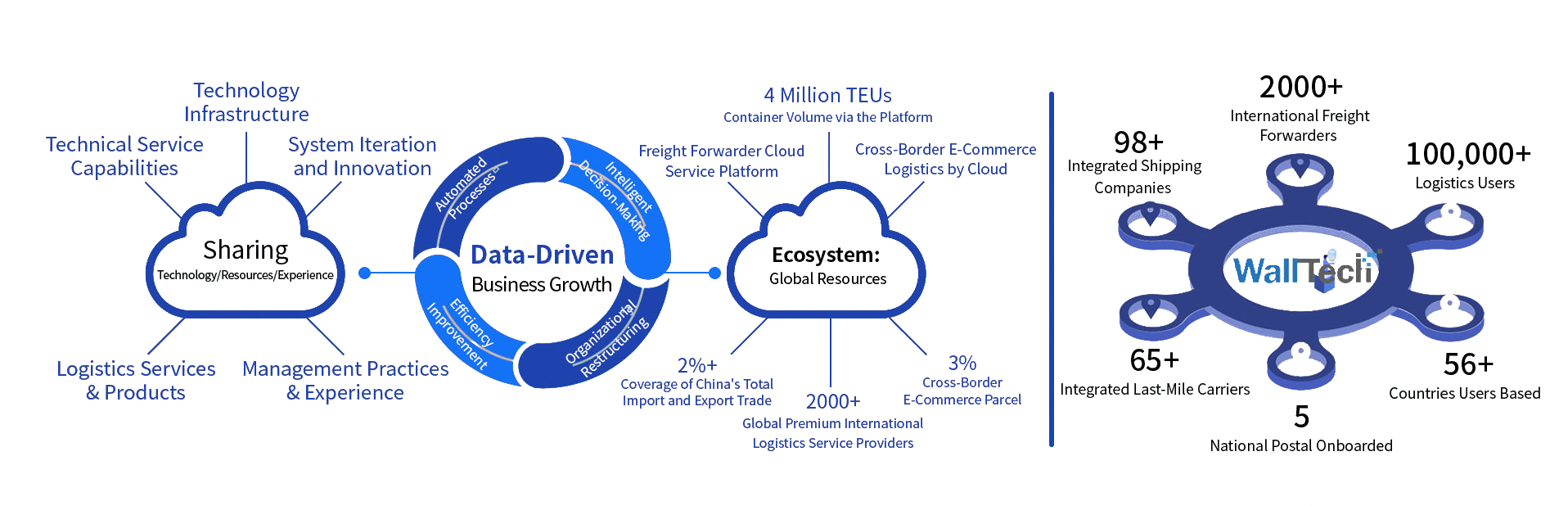

WallTech approaches logistics SaaS from a different perspective.

Like most modern platforms, WallTech's SaaS solutions adopts a transaction-based pricing model. The difference is not whether to charge per shipment—but how simple, predictable, and accessible that pricing remains.

WallTech's platforms are designed for forwarders that operate at high frequency, manage costs carefully, and expect technology to support growth—not penalize it.

That means:

Low entry thresholds, so smaller teams can get started without heavy upfront investment

Clear pricing structures, without stacked per-user, per-container, and mandatory add-on fees

Optional AI and automation tools, adopted only when they deliver real operational value

Strong local service and ecosystem connectivity, supporting real-world logistics workflows

The goal is straightforward: make advanced logistics systems usable not just for the largest enterprises, but for the broader forwarding market.

Global Standards, Local Reality

The logistics software industry is maturing. As it does, pricing strategy is becoming just as important as product capability.

Markets differ in cost tolerance. Business models vary. Operational realities are deeply local.

Sustainable digital transformation does not come from charging more often—but from building systems that companies can afford to grow with.

As pricing models continue to evolve, forwarders are making their priorities clear: clarity over complexity, flexibility over rigidity, and long-term value over short-term sophistication.

At WallTech, our focus remains the same—to grow alongside logistics companies, offering software that is practical, accessible, and built for sustainable global operations.

Simplify Global Logistics.